The global economy is entering an exciting and transformative phase. With advancements in technology, shifting consumer preferences, and increasing awareness about sustainability, businesses are presented with unprecedented opportunities to innovate and grow. As we approach 2026 and beyond, identifying the right sectors for investment will be essential for organizations aiming to stay relevant, agile, and resilient in an increasingly competitive marketplace.

Investments are no longer solely about short-term profits. The most successful businesses are those that invest in areas aligned with future trends, societal needs, and technological advancements. From artificial intelligence to healthcare innovation, the opportunities are vast—and navigating them requires strategic insight and data-driven decisions.

This article explores the top investment opportunities businesses should focus on in 2026 and the years that follow, supported by research, statistics, and real-world examples. By understanding these emerging sectors, companies can better position themselves for sustainable growth while creating value for their customers, employees, and shareholders.

What are Investment Opportunities?

Investment opportunities refer to sectors, industries, or technologies where businesses can allocate capital and resources to generate returns, foster innovation, and expand their reach. These opportunities often arise due to changes in market dynamics, technological breakthroughs, regulatory shifts, or evolving customer expectations.

For businesses, identifying and acting upon the right investment opportunities ensures competitive advantage, long-term profitability, and improved resilience in the face of uncertainty. Whether it’s investing in renewable energy, digital platforms, or healthcare solutions, these opportunities are driven by both current trends and anticipated needs.

With global challenges such as climate change, rising healthcare costs, and data security concerns, businesses are increasingly looking for sectors that not only promise growth but also create positive impact. Below, we delve into some of the most promising investment opportunities for 2026 and beyond.

Top Investment Opportunities for Businesses in 2026 and Beyond

1. Green and Sustainable Technologies

One of the most urgent global challenges today is climate change. Governments, investors, and consumers are demanding environmentally responsible solutions, making green technologies one of the fastest-growing investment areas. According to BloombergNEF’s 2025 forecast, global investment in clean energy and sustainability is expected to exceed $2.7 trillion by 2026.

Businesses that invest in renewable energy sources like solar and wind power are not only reducing their carbon footprint but also benefiting from lower long-term operational costs. The adoption of electric vehicles is expected to surge, with projections suggesting that 20 million EVs will be sold annually by 2026. Investing in EV infrastructure, battery storage technologies, and smart grids will open new avenues for growth.

Moreover, sustainable supply chain management and eco-friendly packaging solutions are attracting significant attention. A Nielsen report from 2023 revealed that 73% of global consumers are willing to change their consumption habits to reduce environmental impact. Companies investing in responsible sourcing, carbon-neutral logistics, and waste reduction initiatives are poised to gain consumer trust and loyalty.

2. Artificial Intelligence and Automation

Artificial intelligence (AI) and automation continue to be at the forefront of business transformation. According to the International Data Corporation (IDC), global AI spending is expected to surpass $500 billion by 2026, growing at an annual rate of 20%.

AI’s influence spans across industries—from customer service to predictive analytics, logistics, and supply chain optimization. Businesses that leverage AI-driven solutions have reported up to 40% cost savings and significant improvements in efficiency and customer satisfaction.

Intelligent chatbots, fraud detection algorithms, and demand forecasting models are already helping companies reduce operational risks and improve decision-making.

Automation, including Robotic Process Automation (RPA), allows businesses to offload repetitive tasks, freeing up human resources for strategic initiatives. This shift not only boosts productivity but also enhances employee satisfaction by reducing mundane workloads.

Investing in AI-driven technologies will be critical for businesses looking to gain a competitive edge while optimizing processes and reducing operational costs.

3. Healthcare and Biotechnology

The healthcare industry is experiencing an unprecedented transformation fueled by digital technologies, personalized care models, and advances in biotechnology. Global healthcare spending is projected to surpass $12 trillion by 2026, according to Global Market Insights, with biotech investments growing at a CAGR of 9–12% annually.

Personalized medicine, telehealth services, and wearable devices are revolutionizing how healthcare is delivered. Innovations such as gene editing, immunotherapy, and AI-assisted diagnostics are opening doors for more effective treatments, faster drug development, and cost-efficient patient care.

The aging global population, coupled with rising chronic diseases, has created immense demand for healthcare infrastructure, medical devices, and wellness programs. Businesses investing in healthcare platforms, remote monitoring, and predictive analytics are well-positioned to capitalize on these trends.

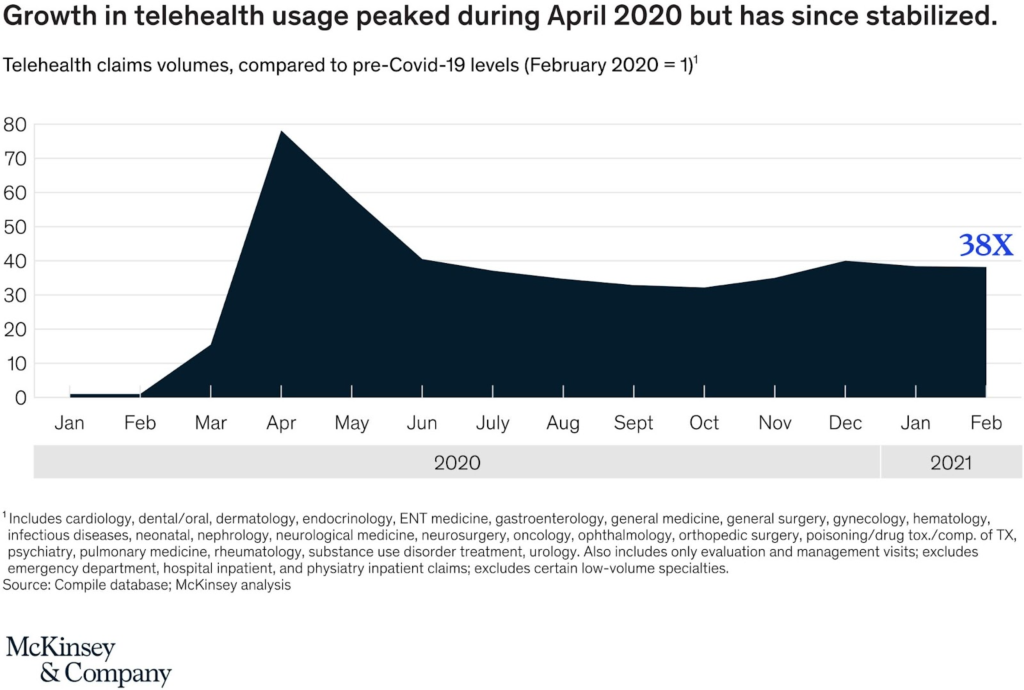

Moreover, telehealth usage has surged, with McKinsey reporting a 38x increase in virtual care usage since the pandemic. Healthcare startups focusing on patient engagement platforms, secure health records, and AI-based monitoring tools are attracting substantial funding and partnerships.

Source: (MCKinsey)

4. Cybersecurity and Data Privacy

As digitalization accelerates, data security has become a top priority for businesses. Cyber threats such as ransomware attacks, phishing scams, and data breaches have exposed vulnerabilities across sectors, making cybersecurity a critical area for investment.

Cybersecurity Ventures forecasts that global spending in this sector will reach $345 billion by 2026. The rising adoption of Internet of Things (IoT) devices, cloud computing, and remote work models has expanded attack surfaces, increasing the need for robust data protection mechanisms.

Companies are investing in encryption technologies, identity verification systems, and AI-driven threat detection tools to safeguard sensitive information. Additionally, regulatory frameworks like GDPR and CCPA are pushing organizations to adopt stringent data privacy measures, further emphasizing the importance of investment in this area.

Investments in cybersecurity not only protect assets but also build consumer trust, ensuring long-term relationships and brand credibility.

5. Digital Experiences and Event Technology

The way businesses interact with customers and stakeholders is evolving. Digital experiences—whether through virtual events, webinars, or hybrid conferences—are becoming integral to engagement strategies.

The global virtual events market is projected to reach $404 billion by 2027, with a 23.7% annual growth rate, according to Grand View Research. Hybrid formats, combining physical and virtual attendance, are becoming the norm for conferences, training sessions, and product launches.

Investing in event technology solutions such as registration platforms, analytics tools, and virtual networking interfaces is crucial for businesses aiming to enhance audience interaction. Platforms that offer seamless ticketing, event management, and personalized communication are gaining traction.

For instance, tools like Yotix – your event ticketing platform are helping businesses create engaging experiences while collecting actionable data to refine future events and better understand customer preferences.

6. Fintech and Digital Payment Solutions

The financial services sector is undergoing a digital transformation driven by mobile banking, blockchain technologies, and innovative payment solutions. The global digital payments market is expected to surpass $10 trillion by 2026, according to Statista.

Emerging areas such as blockchain-powered transactions, buy-now-pay-later services, and cross-border payments are redefining how money is transferred and verified. Fintech startups are offering scalable and cost-effective solutions to meet the evolving expectations of consumers and businesses alike.

Investment opportunities in digital wallets, subscription platforms, and decentralized finance (DeFi) solutions are expanding, with over $100 billion invested in fintech ventures in 2024 alone, as reported by CB Insights.

Adopting these solutions enables faster transactions, greater transparency, and improved customer experiences, making fintech one of the most promising investment areas for businesses in the years to come.

7. Education Technology and Remote Learning

Education technology has emerged as a powerful tool to democratize learning, upskill workforces, and expand access to knowledge. According to HolonIQ, investments in edtech are expected to exceed $404 billion by 2026, driven by growing demand for remote learning and reskilling initiatives.

AI-driven learning platforms, gamification tools, and interactive classrooms are enhancing engagement and improving outcomes. Corporate training programs are also adopting digital formats, helping employees acquire new skills at their own pace.

With the rise of lifelong learning models, companies investing in edtech are poised to meet the growing demand for adaptive learning solutions that respond to changing industry requirements.

Conclusion

As we look toward 2026 and beyond, businesses must be proactive in identifying and investing in areas that align with technological advancements, customer expectations, and societal needs. From sustainable technologies and AI to healthcare innovations and cybersecurity, the opportunities for growth are abundant.

Strategic investments today will not only drive immediate results but also create long-term resilience, customer trust, and brand loyalty. Leveraging cutting-edge tools like event ticketing platform can further enhance engagement, streamline processes, and build meaningful connections with customers and stakeholders.

Whether you are a startup founder, investor, or established enterprise, aligning your investment strategy with emerging trends will help you navigate uncertainty and unlock growth. The time to act is now—embracing innovation, sustainability, and data-driven solutions will shape the future of business in ways we’ve only begun to imagine.